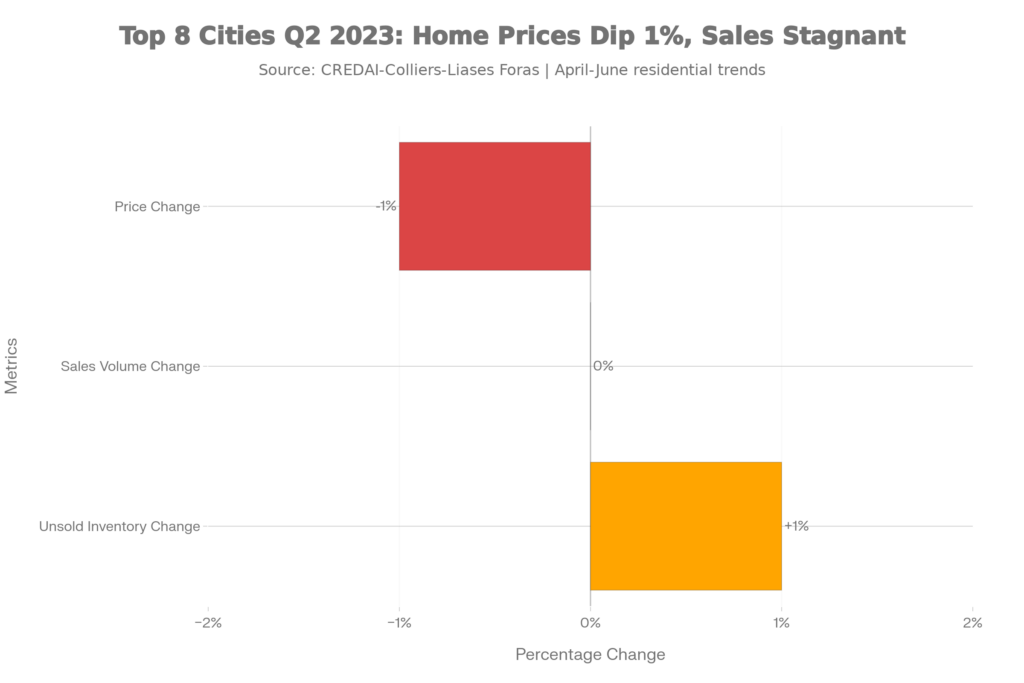

Bengaluru, June 30, 2023 – India’s residential real estate market across the top eight cities experienced a mild cooldown in the April-June quarter, with home prices dipping by 1% and sales volumes remaining largely stagnant, according to the latest Housing Price-Tracker Report from CREDAI-Colliers-Liases Foras.

Key Market Indicators

Unsold inventory edged up marginally by 1% across these cities, driven by increases in Chennai and Mumbai Metropolitan Region (MMR) at 3% each, alongside a 2% rise in Kolkata. Ahmedabad and the National Capital Region (NCR) saw a slight 1% reduction in unsold stock, while Pune held steady. This pause follows two years of robust post-pandemic recovery, signaling buyer caution amid rising interest rates and global economic pressures.

Bengaluru’s Resilient Performance

Bengaluru bucked some national trends, maintaining relative stability with end-user demand from IT professionals supporting sales in key corridors like Whitefield and Sarjapur Road. Despite the quarterly price softening, the city’s overall housing prices had climbed 14% year-on-year earlier in Q1, with peripheral areas showing even stronger gains of up to 39%. Developers continue launching mid-segment 2-3BHK units, which captured over 80% of Q2 transactions citywide.

Implications for Buyers and Developers

Stagnant sales highlight a shift toward value-driven purchases, with 2BHKs leading at 45% of Bengaluru’s deals as families prioritize affordability. Unsold stock pressures may prompt selective price adjustments, but long-term outlook remains positive given steady job growth and infrastructure pushes like the airport corridor. Experts advise end-users to explore North Bengaluru pockets for balanced appreciation potential.