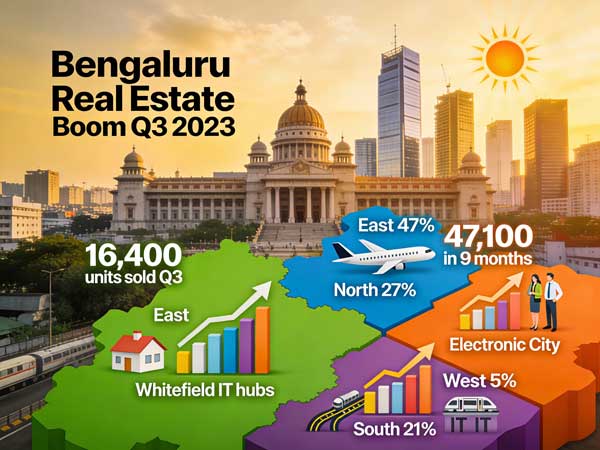

Bengaluru’s real estate market showed strong resurgence in August 2023, part of Q3 trends reflecting post-COVID recovery with robust sales growth. Residential sales hit 47,100 units in the first nine months of 2023, surpassing full-year 2022 figures of 49,500 units.

Q3 2023 Sales Surge

Bengaluru recorded 16,400 residential units sold in Q3 2023 (July-September), up 30% in new launches from Q2’s 11,400 units. Year-on-year, Q3 sales jumped 60% to 12,590 units from 7,890 in Q3 2022, with 86% quarterly growth over Q2 2023. East Bengaluru led with 47% of sales and 16% QoQ rise, while inventory overhang stayed low at 10 months.

Bengaluru’s real estate market in Q3 2023 (including August) saw the strongest post-COVID resurgence in East, North, and South zones, with East leading sales and launches. These segments benefited from IT hubs, metro connectivity, and spacious housing demand.

Growth by Zone

East Bengaluru dominated with 47% of citywide sales (up 16% QoQ) and 54% of new launches (up 22% QoQ). North Bengaluru captured 27% of sales and 26% of launches with 62% QoQ growth in launches. South Bengaluru followed at 21% sales share and 17% launches (21% QoQ rise), while West held 5% with steady 5% QoQ sales growth.

Key Localities

- East Bengaluru (Whitefield, KR Puram, Varthur): Led due to IT corridors and metro Phase 2; 52% of inventory here.

- North Bengaluru (Hebbal, Yelahanka, Thanisandra): Airport proximity and tech parks drove 62% launch surge.

- South Bengaluru (Electronic City, Bannerghatta): Infrastructure like Yellow Line metro boosted demand.

Updated Statistics

Key Recovery Drivers

Employee returns to IT offices post-pandemic boosted demand, alongside preferences for spacious homes after lockdowns. Low interest rates, job market stability, and infrastructure like metro expansions in KR Puram and Whitefield fueled confidence. Mid-segment homes (Rs 80 lakh-Rs 1.5 crore) dominated 64% of launches.

Market Statistics

Future Outlook

Analysts noted sustained momentum from pent-up demand and economic rebound, positioning Bengaluru as a top recovery market. Property prices rose 18% YoY in Q3, driven by luxury launches in periphery areas.